The ear, nose and throat (ENT) market, also known as otolaryngology, encompasses a wide range of services. For our purposes, we categorize all ENT and allergy-related services under the ENT subsector. This classification is based on the comprehensive expertise of otolaryngologists, who are trained in both medical and surgical treatments pertaining to the head and its associated areas.

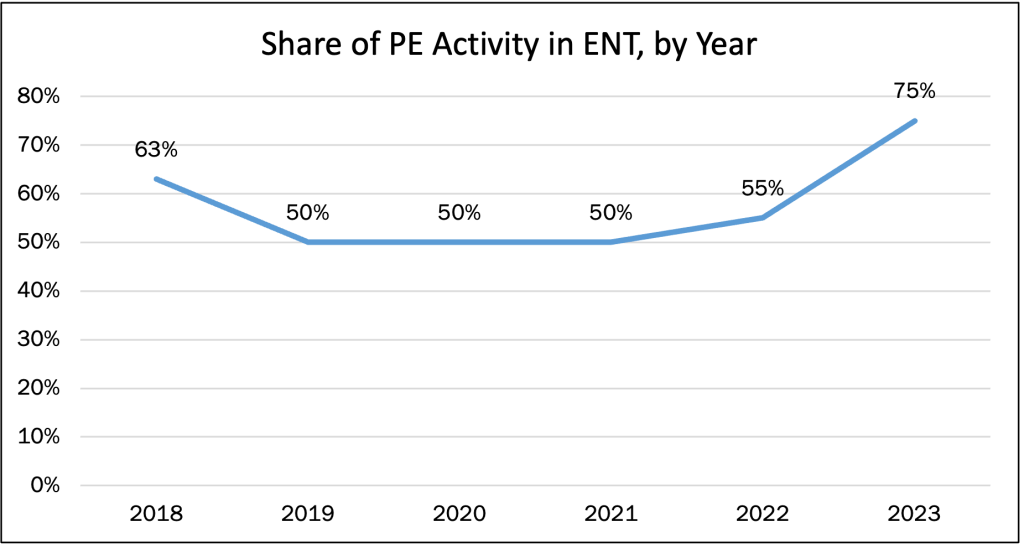

The ENT market has experienced an influx of deal activity over the last few years. According to data captured in the LevinPro HC database, there were eight acquisitions in 2018, and four were reported in 2019. Deal volume hit a low in 2020 with two transactions. M&A activity then sprung back in 2021 with 14 acquisitions but fell again in 2022 when 11 deals were announced. The sector experienced its highest deal volume so far in 2023 with 20 acquisitions. Through the first two months of 2024, only one ENT transaction was reported.

The reasons to invest in the ENT industry can be summarized as the opportunity to break into new markets, consolidation and room for ancillary services.

New Markets

In our research for the ENT market, one aspect that kept coming up was the fact that most ENT physicians are based in more urban areas of the country with little to no presence in rural communities. While this problem is not restricted solely to otolaryngologists, it is unique to this space because there has been an overall increase in demand for ENT/allergy care.

It makes sense that most ENT care occurred in urban areas as children were not exposed to allergens as frequently when young (in 2021, more than 42% of people with allergies were reported to live in urban areas, according to the National Library of Medicine). But that is changing as more children spend a significant amount of time indoors and develop allergies. According to the Centers for Disease Control and Prevention (CDC), nearly 1 in 3 adults and 1 in 4 children in the United States report having a seasonal allergy, eczema or food allergy as of 2022. The CDC also reported in 2021, more than 8% of adults had asthma, which increased from 6.9% in 2001.

With such a large presence of allergens and asthma, there is the opportunity to break into the new market of rural communities and provide ENT/allergy/asthma care.

We spoke with Jeremy Murphy, Vice President at Physician Growth Partners, who had this to say about otolaryngology care in rural and secondary communities: “M&A activity historically has always been most dense around primary markets. As a whole and going forward, finding a solution to provide accessible, high levels of care in secondary and tertiary markets will be a necessary priority for medical providers.”

Even our data supports the fact that rural communities are becoming more popular for ENT transactions. In 2023, there was only one ENT transaction where the target was based in a market with more than 100,000 residents. The rest occurred in smaller cities and towns, which indicated that rural communities need the care. Since urban areas are relatively saturated, rural markets have more opportunities and less competition, even as emerging markets.

Ancillary Services

In conjunction with the rise in demand, there is the prevalence of ancillary services that makes the ENT industry desirable. In the ENT space, ancillary services include ambulatory surgery centers, allergy testing, asthma care, audiology testing, sleep disorder clinics and pediatric allergy/ENT care.

Murphy also addressed how ancillary services are key factors for investors when deciding whether to invest.

“The opportunity for ancillary service introduction and capture is always going to be one of the biggest drivers of investor interest, agnostic of specialty,” said Murphy. “In the ENT space specifically, options are quite expansive.”

With such a large scope of ancillary services that otolaryngologists can provide, each practice has a sizable base for revenue and does not rely on one type of service to be profitable. Murphy noted that as ancillary services provide a mixed stream of revenues, ENT providers are less affected by headwinds which makes them more attractive to investors.

Consolidation

In terms of room for consolidation, while there are many private equity groups that have made singular acquisitions over the years, there are not many firms that dominate the space, meaning the market is rather fragmented. According to our data, the most active private equity firms in the ENT space are Audax Private Equity, Shore Capital Partners and Thompson Street Capital Partners, each having completed seven acquisitions since 2017.

“Fragmentation, like ancillary services, will always drive deal activity and interest from investors,” said Murphy.

Murphy also notes that investor interest is further enhanced because there will be more room for investors to grow the practice and scale up its operations. Grouped together with the reasons explored above, because the market is highly fragmented, there are endless deal-making opportunities for private equity groups and other investors alike.

More previous installments in our “Why Invest In…” series, please go to the following sites: Why Invest in the Nephrology Market and Why Invest in the Dental Market.