We sat down and spoke with industry expert Andre Ulloa, Partner and Executive Advisor of M&A Healthcare Advisors, to discuss the key considerations investors should know before investing in the health clinic market. Ulloa sheds light on the factors driving the recent surge in health clinic investment, and what’s to come for this booming market.

What is a Health Clinic?

A health clinic, also called a walk-in clinic, is a convenient option for immediate, non-emergency medical care. These types of clinics can treat a wide range of conditions, such as the flu, strep throat, small cuts and skin infections. They can also provide services like physical exams, immunizations and similar routine care. Unlike a typical doctor’s office, walk-in clinics typically don’t take appointments and care is provided on a first come, first served basis.

In addition to convenience and preventive care focus, health clinics boast several competitive advantages attractive to investors. These include lower operational costs due to streamlined operations and a focus on non-emergency cases. This translates to higher profit margins. Patients also benefit from shorter wait times compared to traditional emergency rooms (ERs) and hospitals. Clinics can see more patients daily, boosting revenue potential. Furthermore, many clinics prioritize preventative care through services like vaccinations and screenings, aligning with the healthcare industry’s growing emphasis on population health management.

Health clinics are not to be confused with urgent care. There are distinct differences between the two that investors should remember:

“The baseline business model is the same. You’re taking walk-in patients, and you’re immediately addressing their needs,” said Ulloa. “The distinction between health clinics and urgent care may lie in their focus and scope of services. While urgent care can handle a variety of non-emergency issues, health clinics may encompass a broader range of diagnostic and treatment services. In all cases, testing and treatment are for non-life-threatening conditions.” This differentiation underscores the comprehensive nature of health clinics, positioning them as holistic healthcare destinations capable of catering to a wide range of medical needs, beyond the immediate health concerns addressed by urgent care.

The Appeal of Health Clinics:

The appeal of health clinics, especially for those looking to invest in the market, extends beyond just patient convenience. During our talk with him, Ulloa emphasized the importance of a recurring revenue stream for investors:

“For a buyer, the most important thing is recurring revenue,” said Ulloa. “Do I know that I can continue to make this money?”

This focus on sustainable income underscores the appeal of health clinics, which not only offer a more streamlined alternative to emergency room visits but also benefit from government reimbursement policies aimed at diverting non-urgent cases away from overstretched ERs, particularly in the post-COVID-19 era. For investors, that translates into a predictable and secure income stream, a critical factor for attracting long-term investors in the healthcare landscape.

However, Ulloa also warns against overreliance on government reimbursement.

“Investors put too much stock into government reimbursement,” he said. He cautions that government reimbursements may not keep pace with inflation, potentially undermining the long-term viability of clinics and limiting their ability to provide affordable care. While government reimbursement plays a role in attracting investors, Ulloa highlights alternative models that offer greater revenue diversity, sustainability and profitability.

“There are cash payor and closed network models that are significantly more sustainable and profitable,” said Ulloa.

Exploring these alternative models further, cash payor systems involve patients paying for services directly out-of-pocket, bypassing reliance on government reimbursement. Closed network models, on the other hand, involve partnerships with specific insurance providers or employers, guaranteeing a steady stream of patients and payments. Embracing these diverse revenue channels, rather than government reliance, health clinics can fortify their financial resilience and thrive in an ever-evolving healthcare landscape.

Health Clinic Market Trends:

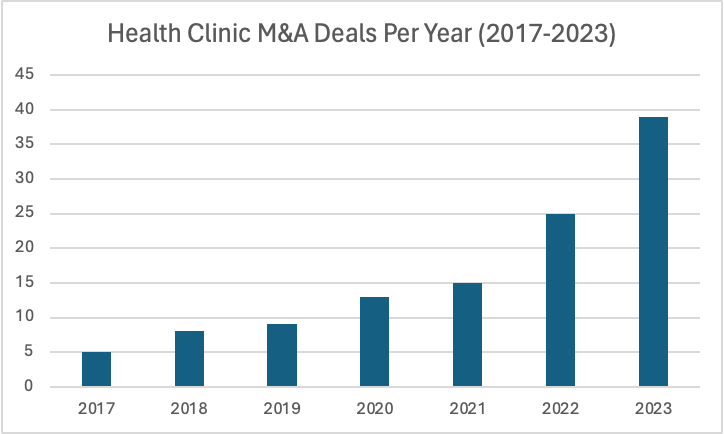

Ulloa’s observations are supported by market data, which reveals a significant uptick in health clinic mergers and acquisitions in recent years (as seen in the graph below). During 2023, there was a 56% increase in deals in the space year-over-year, and 2022 had a year-over-year increase of 67%, according to data captured in the LevinPro HC database. The market has been on the rise for several years now, especially since 2021.

Source: LevinPro HC, March 2024

The uptick in M&A transactions can be attributed to various factors, including the economic repercussions of the COVID-19 pandemic. As Ulloa notes, and confirmed by our data, 2021 and 2022 were record years for healthcare transaction activity.

“That wave of deal flow was due to low cost of capital, PPP/Stimulus recipients being released from the liabilities, and spill over from the economic pause caused by COVID-19. At the advent of COVID-19, clinics were hurting and testing centers were doing extremely well,” said Ulloa. “The clinics of today benefit from the fact that testing centers are all but extinct and those patients have familiarized themselves with the walk-in clinic model (ie urgent care vs. ER). When coupled with government support the clinic segment has been an attractive target for investors.”

While the initial surge in demand may have been triggered by a response to COVID-19, the underlying factors driving patient preference for convenient and efficient care remain strong, ensuring the continued relevance of health clinics in the post-pandemic landscape, as we’re seeing now. There have already been eight health clinic transactions announced during 2024 (between January 1, 2024 and March 25, 2024), which is already ahead of the seven transactions announced during the same time last year. A small increase, but still an increase that could indicate good things for the market this year. However, with that optimism there needs to be a balance of skepticism, as Ulloa discusses in the next section.

Future Outlook:

Despite the optimistic outlook, Ulloa suggests caution regarding the sustainability of rapid growth in the health clinic market. He remarks, “When you see growth like this in M&A activity, you always have to take pause and say, wait, if things can grow this fast, they can also decline just as quickly.” Indeed, rapid expansion can be a double-edged sword, and prudent investors recognize the need for vigilance.

Ulloa expresses skepticism regarding the potential for continued exponential growth in the health clinic market.

“Will [the health clinic market] see much more growth than what it’s seen in the last couple of years? Doubtful in my opinion,” said Ulloa.

As the sector matures, Ulloa anticipates a period of stabilization. However, this stabilization shouldn’t be seen as a stagnation. The allure of the health clinic model will persist, but strategic diversification will be the watchword. Perhaps digital health, home health or value-based care initiatives will be the cornerstone of that diversification, but time will tell.

Check out previous installments in our “Why Invest In…” series: Why Invest in the ENT Market, Why Invest in the Nephrology Market and Why Invest in the Dental Market.